News

Ringing Out 2016 in QuickBooks

2016-10-18 | by Gene B. Reynolds, CPA

For the past year, you’ve been faithfully creating new records, entering transactions, and recording payments. You’ve run basic reports. You’ve done your collection duties. You may have even paid employees and submitted payroll taxes.

For the past year, you’ve been faithfully creating new records, entering transactions, and recording payments. You’ve run basic reports. You’ve done your collection duties. You may have even paid employees and submitted payroll taxes.

Now that another year has come and gone, if you haven’t done so, it’s time to wrap and review those work tasks that should have been completed by December 31. First up is your annual QuickBooks wrap-up.

Create and send year-end statements.

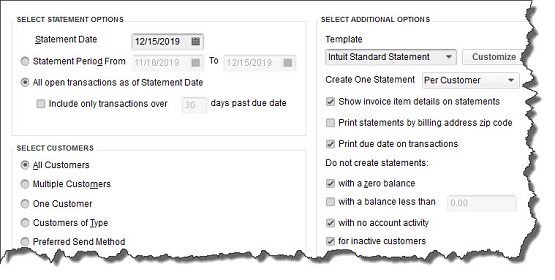

Figure 1: As your customers wrap up 2016, too, it’s good to send statements to past-due accounts.

In an ideal world, all of the invoices that were due in December would be paid off by the end of the year. We all know that that’s not usually the reality. Two reports can help you here: the A/R Aging Summary and Open Invoices.

If you didn’t give everyone a chance to clear their accounts before December 31 by sending statements, do so now. Click Statements on the Home page (or Customers | Create Statements) to open the window pictured above.

You have multiple options here that are fairly self-explanatory. The screen above is set up to create statements for all customers who have an open balance as of the date you select, but not for inactive customers or those with a zero balance or no account activity.

That way, no one who’s paid in full to date will receive a statement. Of course, if you didn’t want statements created for anyone who’s less than 30 days past due, you’d click in the box in front of Include only transactions over and enter a “30” in the following field.

Tip: You can also find out who is overdue by clicking on the Customers tab in the left vertical pane to open the Customer Information screen. Click on the down arrow to the right of the field just below Customers & Jobs. QuickBooks provides several filters for your list.

Reduce your inventory.

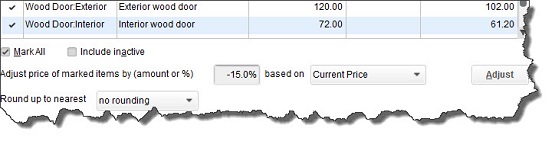

Figure 2: Want to discount all or selected items in your inventory by the same percentage or amount? Open the Customers menu and click Change Item Prices.

If you only sell a few products, you probably already know what didn’t sell well in 2016. If your stable of products is larger, you can run QuickBooks reports like Inventory Stock Status by Item and Sales by Item Detail to identify your slow-sellers and discount them now. You may need to filter your reports to see the right data. Please call to discuss customization options if you’re unsure of how to do this.

Clean up your contact lists.

If you don’t maintain your customer and vendor lists, you’ll eventually start wasting time scrolling through them when you enter transactions. So this would be a good time to designate those contacts that you’ve not dealt with in 2016 as Inactive (you can delete their records entirely, but we advise against that). Simply open a Customer record, for example, and click the small pencil icon in the upper right to edit it. Click on the box in front of Customer is inactive.

Send holiday greetings to customers and vendors.

If you didn’t get around to doing this last month, then consider sending a greeting in January (Best Wishes for a Successful 2017!) when your customers’ and vendors’ lives have slowed down a bit. You’re less likely to get lost in the crowd. If your lists are short enough, personalize these cards as much as possible. At least sign them by hand if you can.

Tip: You can print customer labels for your cards directly from QuickBooks. Open the File menu and then click Print Forms | Labels.

Run advanced reports.

Finally, if you’re not already using a QuickBooks professional to create and analyze advanced financial reports (found in the Accountant & Taxes submenu of Reports) monthly or quarterly, then you should be. They’re important, and they give you insight into your business financials that you can’t get on your own. Please call if you need assistance with this task.

Thank you for being a client in 2016 and best wishes for a successful 2017!

About the Author

Gene B. Reynolds, CPA

Gene is the Founder and President of Reynolds and Associates, a Houston-based CPA Firm. He has spent 42 years helping Houston entrepreneurs navigate their enterprises through both calm and stormy waters.